Taiwan Revenues, TSMC Q2 Preview, AEHR SiC Read-Across, GPU Depreciation Discussion

Chips & Wafers Weekly Update

Taiwan Monthly Revenues

Taiwan co’s started posting June revenues earlier this week.

Naturally, the biggest beneficiaries were those in the AI supply chain that saw tremendous recurring growth.

Asia Vital Components (AVC): cooling component supplier for GB servers - up +93% YoY.

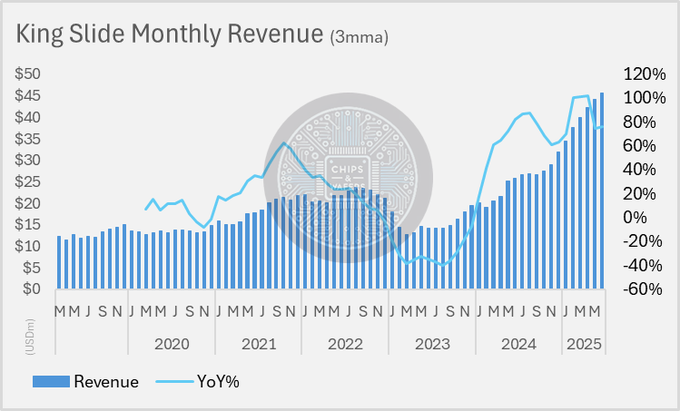

King Slide Works: Mechanical rails supplier for GB server racks - up +77% YoY.

KYEC: Primary GB200 OSAT - up +37% YoY.

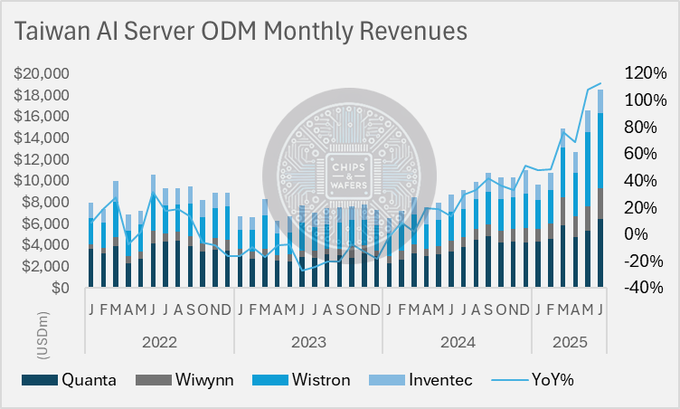

AI Server ODM’s: up +113% YoY total (Wiwynn leading the pack up +205%).

In short - the AI story continues on! These are all positive upstream indicators for overall AI growth and DC expansion, but some of these names make for compelling investment cases in their own right (did you know that King Slide DC rail GM’s are higher than Nvidia’s overall GM?)

TSMC Q2 Preview

TSM 0.00%↑ posted it’s June revenue yesterday and with that total Q2 revenue.

Q2 will be a record quarter for TSMC, totaling around >$30 Billion USD (final USD figure depends on overall calculated fx). Up approximately +45% YoY.

TSMC will be reporting Q2 earnings on Thursday (July 17th), here are a few things to look out for during the call:

Gross Margins: Impact of recent TWD appreciation on GM outlook

Tariff Impact: Last quarter TSMC emphasized they saw no change in customer behavior despite tariff chatter - did this continue in Q2?

CoWoS Capacities: Are they still ramping for 2x annual capacity? Worth listening out for commentary on specific breakdowns between the process types.

Mainstream Demand: Have they seen any changes regarding the return of mainstream application demand?

TSMC Arizona: Any changes to timelines, and have they reconsidered the cluster after the recent Trump admin. initiative for tax breaks on semi-related on-shore manufacturing efforts?

COUPE: Any commentary on the adoption timeline for their Silicon Photonics platform COUPE.

2nm: Any commentary on ramp profile of the newest 2nm node.

There are a lot more that is likely to be discussed, but these are just some topics worth listening out for.

AEHR Read-Across - Silicon Carbide

AEHR 0.00%↑ Test Systems posted a rough Q4 FY25, missing both top and bottom-line expectations: $59M in revenue vs. $70M+ guidance from earlier this year, and a $4.3M pre-tax loss Vs $7M profit guidance. April’s guidance cut, blamed on “ongoing tariff uncertainty,” proved prescient. The effective backlog is just $16.3M, indicating only ~$1M in order growth through mid-Q1 FY26.

Even with record shipments of PPBI systems (boosted by the Incal acquisition), the core business shrank -25% YoY to $50M.

The company is withholding guidance and flagging continued weakness in its key SiC segment, with customers pushing forecasts into late FY26 (CY27/28) and beyond. Growth may return - just not soon.

The point is - SiC saw massive investments in 2022-2023, and the overall capacity and supply chain can likely satisfy any market demand at least for another couple of years.

GPU Depreciation Discussion

Earlier this week, an X user (@Kakashiii111) posted an excellent tweet on the difference in accounting approaches between CRWV 0.00%↑ and NBIS 0.00%↑ with regards to GPU depreciation.

Here is an excerpt just to provide the gist of the discussion:

…Their (CoreWeave & Nebius) equipment is essentially the same. Their revenue models are the same. And yet, their accounting treatment of these assets is anything but the same.

CoreWeave, now valued at an eye-popping $80 billion, has stockpiled hundreds of thousands of GPUs — many of which are basically acting as collateral for loans and debts. But that doesn’t really matter. After all, GPUs don’t depreciate that fast… right? Well, that depends who you ask — Magentar or NVIDIA.

NVIDIA, for its part, announced last year that it’s moving from a two-year product cycle to a one-year cycle. Meaning: GPUs, which were already aging fast, are now expected to become outdated twice as quickly.

But apparently, that’s not something CoreWeave is too concerned about. CoreWeave still has to deal with the issue of that collateral. And whether GPUs are actually losing value faster or not isn’t the point — what matters is how you write it down.

So, in January 2023, CoreWeave made a simple fix: it extended the depreciation period for its GPUs from four years to six (!). And even after NVIDIA’s change in strategy made that timeline questionable — nothing changed.

Nebius, by contrast, depreciates the same class of hardware over four years. That’s a full two-year difference.

We posted a response tweet highlighting the importance of this discussion and it’s likely proliferation amid ever-changing product hardware cycles (unlike anything we’ve seen before).

One point from there worth noting: Just because 2 neo-clouds deploy similar hardware - doesn’t necessarily mean we should expect parity when it comes to accounting principles. Data Center and hardware maintenance play a huge role in the overall useful lifespan of these assets, and in our view it actually is possible to have the same hardware with 2 different lifespan expectations.

As mentioned in the beginning, with GPU obsolescence timeframe minimizing between running harder workloads and product cycles shortening, this discussion will only grow more interesting. Guaranteed to be interesting.

If you haven’t yet seen: Be sure to check out our most recent post on Mainstream Demand Recovery that we put out earlier this week through the lens of ABF Substrates. Very pertinent data for the investment community out there.

ABF Substrates – Signs of a Mainstream Demand Recovery?

Just below the chip sits the PCB’s sexier brother: the IC substrate.

That’s a wrap for now. See you next week!

Chips & Wafers Team

Thanks for covering GPU depreciation. Find it quite interesting how these business moves are impacted by accounting standards (or lack thereof)