Chiplet Alliance Wars, Samsung HBM Resurgence, BESI CMD Analysis, C&W June Data Book

Chips & Wafers Weekly Update

Chiplet Alliance Wars – TSMC vs. Intel

This past week, INTC 0.00%↑ posted a tweet announcing their newly formed Intel Chiplet Alliance:

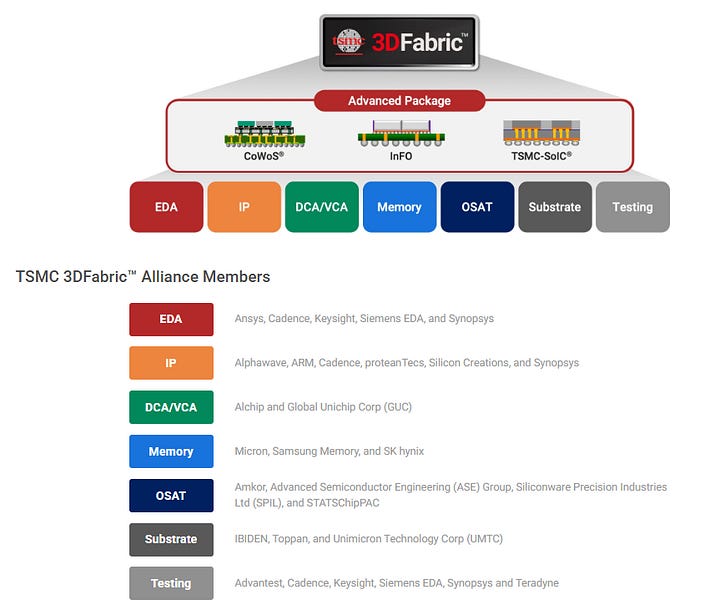

This is a clear signal that Intel sees the future running through chiplets. But they’re not the first. TSM 0.00%↑ already has a well-established chiplet ecosystem of its own: the 3D Fabric Alliance.

You don’t need to be an industry veteran to see the differences between the two lineups. It’s so obvious it almost smacks you in the face.

Where are Intel’s HBM partners? Substrate suppliers? Non-EDA IC design vendors? OSAT’s? The list is almost appallingly irrelevant to next-gen semis.

The answer lies in the purpose of these alliances. Foundries and IDM’s build alliances to foster standardization, strengthen supplier/customer dynamics, and provide a cohesive solution across the complex semiconductor supply chain.

More significantly, though, is the reason why companies choose to join alliances.

These firms join alliances because the alliance leader provides early access to their future product roadmap. That’s the equivalent of gold in semiconductor IP—it lets partners align their product portfolios with the future, not just the present.

And that’s why there isn’t a line out the door to join Intel’s alliance. Their roadmap is unclear. Their past is littered with broken promises. And the clear winner in the age of heterogeneous integration isn’t in Santa Clara—but rather in Hsinchu.

Samsung HBM Resurgence

On June 17th, it was reported that Samsung secured HBM3E orders from AVGO 0.00%↑, following a recent win supplying HBM to AMD 0.00%↑.

Samsung has long been lagging in the HBM race. SK Hynix continues to reign supreme and MU 0.00%↑ has made meaningful headway, recently announcing the shipment of several 12-Hi HBM4 samples to multiple customers.

While we don’t expect Samsung to take the lead anytime soon, it’s worth keeping an eye on them. High-volume HBM wins with top-tier customers present interesting investment opportunities for Samsung’s HBM supply chain—which is not as similar to its competitors as you might think.

BESI CMD Analysis

As we’ve consistently argued, the extension of Moore’s Law increasingly depends on heterogeneous integration and chiplet architectures—enabled by Advanced Packaging. One of the most important companies in this space is Dutch-based BESI.

BESI recently hosted a very well-run Capital Markets Day (CMD) where they laid out their positioning and future outlook.

We published a deep-dive piece breaking down the presentation and commentary. While we continue to view BESI as a high-quality company, some of their forward-looking assumptions seem overly optimistic.

BESI Investor Day – A Closer Look Behind the Optimism

BESI hosted another well-organized and successful Investor Day last week.

To be blunt: we believe they’re disguising pushouts as guidance upgrades, failing to acknowledge internal product cannibalization, and projecting aggressive market share gains in an increasingly competitive space.

If you haven’t read our piece yet—we highly recommend you do.

Chips & Wafers June Data Book

Earlier today, we delivered our June Data Book to our customers with the most recent developments in the semiconductor industry, driven by what we are seeing in our in-house data.

The semiconductor industry is multi-layered and incredibly complex. We work hard to distill large datasets into clear, insightful reports tailored for investors and semiconductor companies to help inform their decision making process.

Interested in our Timely & Targeted Data Books? Sign up here or email us at sales@chipsandwafersdata.com for a free demo.

Below, we’ll be sharing a few individual slides exclusively for our paid subscribers.

That’s a wrap for now. See you next week!

Chips & Wafers Team

June Data Book Selected Slides:

Chips and Wafers is excited to announce a new addition to our Semiconductor industry tacker library; "Key Application Supply Chain Trackers".

Chips & Wafers has developed unique indexes to monitor the performance of end market applications such as Nvidia AI Servers, CoWoS, Apple Supply Chain etc.

These supply chain trackers are unique and valuable proxies used to identify shifts in end market demand for key applications.

To learn more about the specific index trackers we offer and sign up to receive the updated tracker monthly; email us at sales@chipsandwafersdata.com.

Keep reading with a 7-day free trial

Subscribe to Chips’s Substack to keep reading this post and get 7 days of free access to the full post archives.